Vodafone Idea in 2025

Vodafone Idea in 2025 (Vi), a prominent player in India’s telecommunications sector, has been navigating a challenging yet transformative journey. Vodafone Idea in 2025, As a partnership between the Aditya Birla Group and Vodafone Group, Vi provides pan-India voice and data services across 2G, 3G, 4G, and is actively rolling out 5G networks. This blog post explores Vodafone Idea’s growth, current market situation, share price, market value, future potential, and whether investing in Vi is beneficial, optimized for search engines to drive traffic.

Vodafone Idea’s Growth Trajectory

Vodafone Idea was formed in 2018 through the merger of Vodafone India and Idea Cellular, creating one of India’s largest telecom operators. With a subscriber base of over 200 million and extensive network coverage, Vi has been a key player in connecting millions across urban and rural India. The company has focused on expanding its 4G infrastructure and is now investing heavily in 5G deployment, with services launched in 17 priority circles that account for 98% of its revenue.

Recent growth initiatives include:

- Network Expansion: Vi has added over 4,000 new sites to enhance 4G coverage and is deploying advanced technologies like MIMO, cloudification, and open RAN to support 5G rollout.

- Retail Presence: The company has opened 100 new flagship stores, bringing its total to over 500, to boost customer acquisition.

- Digital Services: Vi is diversifying into cloud services, IoT, and business solutions, aiming to evolve into a tech-focused entity.

- Fundraising Efforts: Vi raised ₹24,000 crore through a follow-on public offer (FPO) and plans to raise an additional ₹20,000 crore to support network upgrades and operations.

Despite these efforts, Vi faces intense competition from Reliance Jio and Bharti Airtel, which has impacted its market share and subscriber base. The company reported a 6.47 lakh subscriber loss in April 2025, reflecting ongoing retention challenges.

Current Situation of Vodafone Idea

As of June 2025, Vodafone Idea’s financial and operational landscape presents a mixed picture:

- Financial Performance: For Q4 FY25 (ending March 2025), Vi reported a consolidated net loss of ₹7,166.1 crore, a 6.6% improvement from ₹7,674.6 crore in Q4 FY24. Revenue from operations was ₹10,982.7 crore, up 3.5% year-on-year but down 1.2% quarter-on-quarter. EBITDA grew 3.1% YoY to ₹4,468.09 crore, though the margin contracted to 40.7%.

- Debt and Liabilities: Vi carries a significant debt burden of approximately ₹2.4 lakh crore, with annual interest costs of ₹24,000 crore exceeding its operating profit of ₹17,000 crore. Adjusted Gross Revenue (AGR) and spectrum dues of ₹2,09,500 crore are due starting FY26, with annual payments of ₹23,400 crore projected through FY31.

- Government Stake: The government holds a 49% stake in Vi after converting ₹36,950 crore of spectrum dues into equity, a move that has sparked mixed sentiments among investors.

- Credit Rating Upgrade: CARE Ratings upgraded Vi’s bank facilities to BBB-; Stable from BB+; Stable, signaling improved financial stability.

Despite these challenges, lenders and analysts note that Vi’s financial position has improved, with promising future projections, partly due to potential government relief on AGR dues.

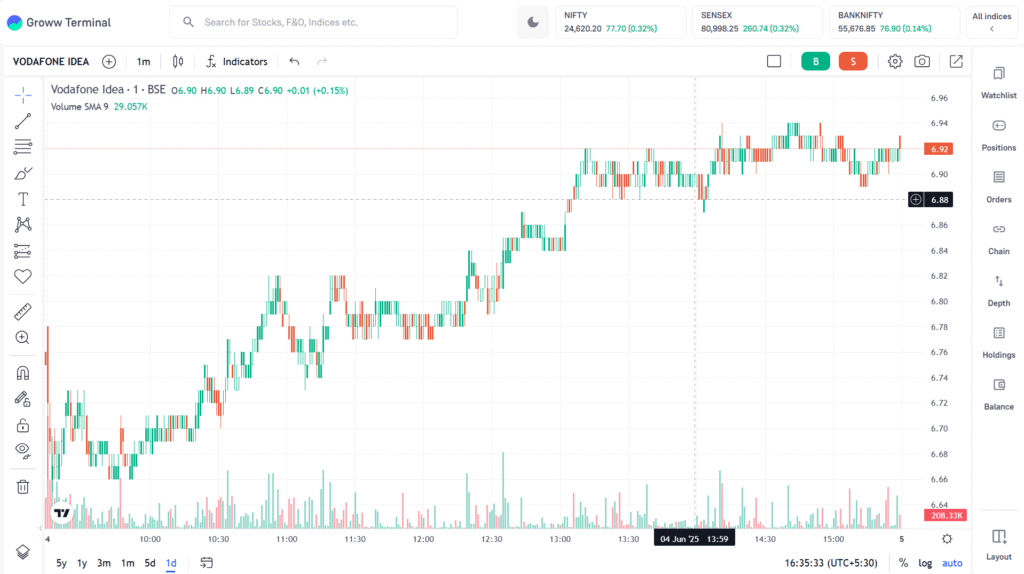

Vodafone Idea Share Price and Market Value

As of June 4, 2025, Vodafone Idea’s share price is approximately ₹6.79 on the NSE, reflecting a 0.3% increase from the previous close of ₹6.77. The stock has experienced volatility, with a 52-week high of ₹19.18 and a low of ₹6.46. Over the past year, the stock has declined by 49.8%, and it is down 15% in the last 30 days.

- Market Capitalization: Vi’s market cap stands at approximately ₹73,673.26 crore (₹734.57 billion), classifying it as a mid-cap company in the telecommunications sector.

- Earnings Per Share (EPS): The EPS for Q4 FY25 was ₹-2.53, with a trailing twelve-month EPS of ₹-4.45, reflecting ongoing losses.

- Analyst Ratings: Analyst sentiment is mixed, with an average 12-month price target of ₹7.84, ranging from a high of ₹15.00 to a low of ₹2.40. JP Morgan upgraded Vi to ‘Neutral’ from ‘Underweight’ with a target of ₹10, citing capital raises and spectrum conversions. However, some analysts maintain a ‘Sell’ rating due to financial challenges and negative free cash flow projections until FY31.

Future Prospects of Vodafone Idea in 2025

Vodafone Idea’s future hinges on its ability to address financial challenges and capitalize on India’s growing telecom market, driven by 5G adoption and digitalization. Key factors shaping its outlook include:

- 5G Rollout: Vi’s investment in 5G infrastructure, supported by partnerships with Samsung, Nokia, and Ericsson, positions it to capture demand for high-speed internet. The company offers unlimited 5G data on plans starting at ₹299, targeting streaming, gaming, and enterprise solutions.

- Tariff Hikes: Analysts suggest Vi needs a 15% tariff hike in FY26 and FY27, and a 20% hike in FY28, to meet AGR and spectrum dues while achieving cash flow neutrality.

- Strategic Partnerships: Collaborations with Microsoft, Google, and Accenture (investing €150 million) enhance Vi’s AI-driven services, such as the Super Tobi chatbot, and support digital transformation.

- Market Trends: India’s telecom sector is expected to grow with increased digital adoption, potentially benefiting Vi if it can stabilize its finances and retain subscribers.

Long-term forecasts are optimistic but cautious. Analysts predict share price targets ranging from ₹30–40 by 2030 and up to ₹90–100 by 2050, driven by 5G growth, debt restructuring, and new revenue streams. However, these projections assume successful execution of Vi’s strategies and favorable regulatory support.

Is Investing in Vodafone Idea Beneficial?

Investing in Vodafone Idea is a high-risk, high-reward proposition. Here are the pros and cons:

Pros

- Growth Potential: Vi’s 5G rollout and digital service expansion align with India’s digital growth, potentially boosting revenue and market share.

- Government Support: The government’s 49% stake and potential AGR relief provide a safety net, improving financial stability.

- Analyst Optimism: Some analysts see a 44% upside by 2030, with a share price target of ₹10.12, making it a potential long-term investment.

Cons

- Financial Strain: High debt (₹2.4 lakh crore) and consistent losses (₹27,383 crore annually) pose significant risks.

- Competitive Pressure: Rivals like Jio and Airtel have stronger balance sheets and larger market shares, challenging Vi’s recovery.

- Analyst Caution: Negative free cash flow until FY31 and a ‘Sell’ rating from some analysts highlight short-term risks.

Investment Recommendation

Vodafone Idea may appeal to risk-tolerant investors with a long-term horizon, given its 5G potential and government backing. However, its high debt, subscriber losses, and competitive pressures make it a speculative investment. Short-term traders should exercise caution due to volatility and weak fundamentals (EPS Rank: 36, RS Rating: 8). For conservative investors, waiting for clearer signs of financial recovery, such as reduced losses or subscriber growth, is advisable.

Conclusion

Vodafone Idea stands at a critical juncture, balancing significant challenges with promising growth opportunities. Its efforts to expand 5G, enhance digital services, and secure funding demonstrate a commitment to regaining market share. However, its substantial debt and competitive pressures require careful monitoring. With a share price of ₹6.79 and a market cap of ₹73,673.26 crore, Vi offers potential for long-term investors but remains a high-risk bet. Stay informed with the latest Vi news and financial reports on platforms like Moneycontrol or NSE India before making investment decisions.

Disclaimer: Investing in securities carries market risks. Consult a financial advisor and review all relevant documents before investing.